Introduction

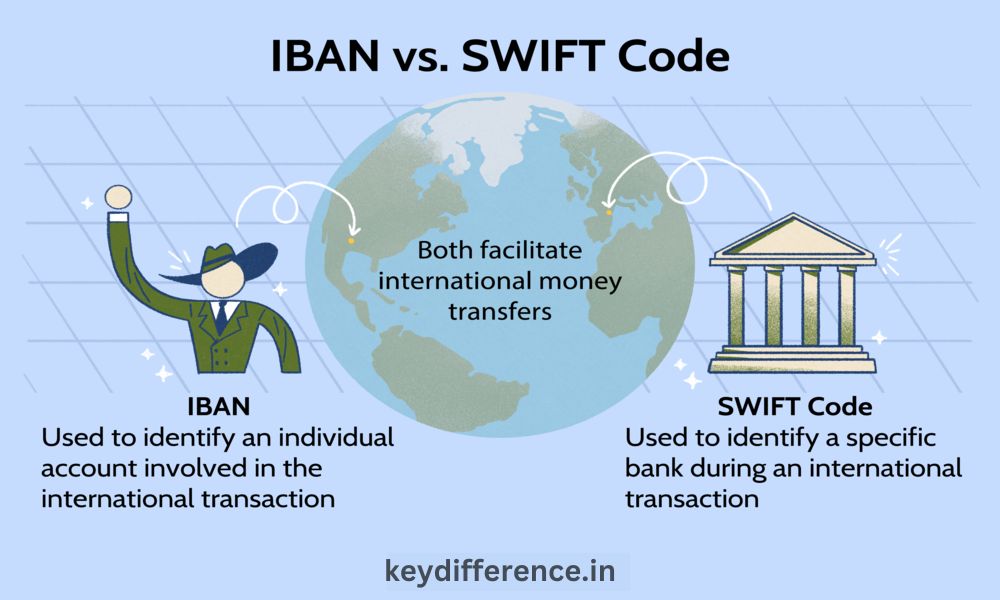

International banking transactions rely heavily on accurate identification of banks and accounts, providing funds are transferred directly to their intended recipients. Unique identification codes like Swift Code and IBAN Code play an integral part of international banking practices and transactions, serving as an easy means for transfer.

The Swift Code, short for Society for Worldwide Interbank Financial Telecommunication code, serves as a unique identifier for banks and financial institutions engaged in cross-border transactions. This ensures secure and precise communication among banks so funds reach the intended recipient on time. Comprising alphanumeric characters as well as components that convey specific information about banks and branches alike.

On the other hand, an IBAN Code, or International Bank Account Number is an internationally accepted numbering system designed to facilitate error-free cross-border payments and creates a unique identifier for every bank account with structures and lengths differing according to each country.

We will delve deeper into the differences between Swift Code and IBAN Code, such as their structures, functions, advantages and limitations as well as industries where they are commonly utilized. By understanding their respective roles and significance in international banking we gain greater insight into what role each of these codes play within it.

What is Swift Code?

Swift Code, commonly referred to as the Society for Worldwide Interbank Financial Telecommunication Code, is a unique identifier used to uniquely identify banks or financial institutions when sending international money transfers. As an internationally recognized standard for bank identification it has become ubiquitously utilized across banking industries worldwide.

Swift codes serve a key purpose: they enable secure and accurate communication among banks during cross-border transactions, guaranteeing funds are transferred to their intended financial institutions while simultaneously helping receiving banks process them correctly.

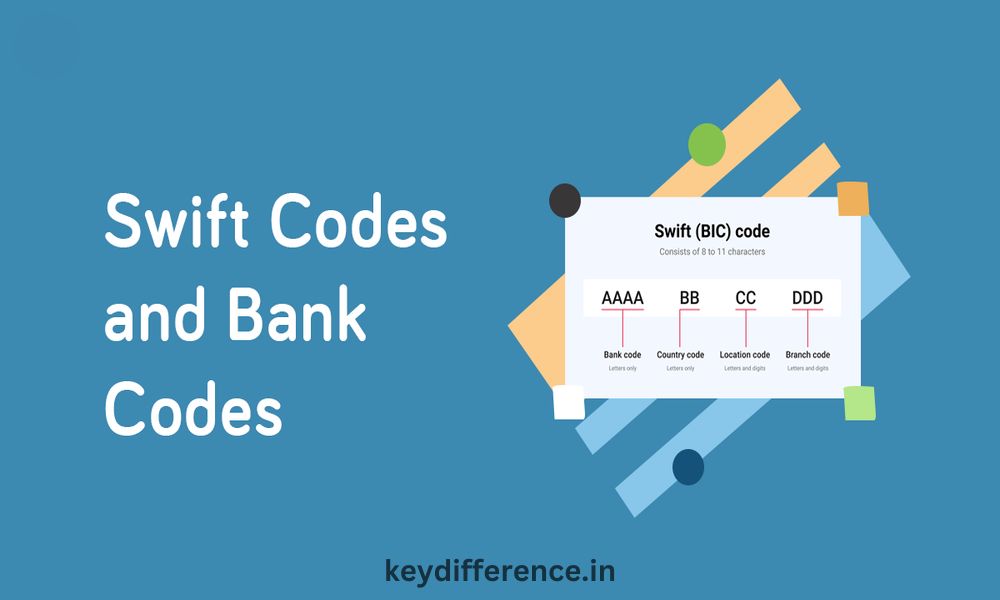

Swift codes are alphanumeric characters standardized across participating banks that represent specific information about them or their branches.

Each character in a Swift code represents specific bank or branch details; its components may include:

Bank Code: An exclusive identifier used to uniquely identify each bank or financial institution.tarii Country Code: Two letter codes that represent the country where a bank resides.

Location Code: Letters and numbers that identify where exactly a bank resides.

Branch Code (optional): An optional code used to further identify each branch of a bank.

Together, these components establish a precise identification of a bank, guaranteeing funds are directed toward their intended recipient. Swift codes are frequently utilized in financial transactions including correspondent banking, international wire transfers, securities trading and interbank communications.

Although Swift codes are widely recognized and utilized worldwide, they do have certain drawbacks that should be considered when conducting transactions involving them.Transactions involving Swift codes may incur higher costs, longer processing times and dependencies on intermediary banks for processing purposes. Furthermore, these codes focus more on identifying a bank or financial institution rather than providing specific account details.

Function of Swift code in international money transfers

Swift codes play a vital role in international money transfers by providing secure communication among banks and ensuring accurate routing.

Here are its primary uses in international transfers:

Identification: Swift code serves as a unique identifier for banks and financial institutions engaging in cross-border transactions, helping accurately identify recipient banks so that funds are directed to the right institutions.

Secure Communication: Swift code provides secure messaging and communication between banks during the transfer process, ensuring that important financial information, instructions, and transaction details are safely sent across.

Routing Instructions: When initiating an international money transfer, the sender’s bank uses the Swift code of the receiving bank to identify an optimal path for funds to travel in. This provides explicit routing instructions that ensure they reach their intended recipient as quickly and smoothly as possible.

Verification and Validation: Swift codes provide an efficient means of validating recipient banks by cross-referencing them against an extensive database of financial institutions maintained by Swift network. This reduces fraud risks while strengthening international transfers’ security.

Correspondent Banking: Swift codes are widely employed in correspondent banking, which involves banks maintaining relationships with other financial institutions to facilitate international transactions on behalf of their customers. Correspondent banks use Swift codes to identify and communicate with their partner institutions.

Interbank Transactions: Swift code is essential in interbank transactions such as clearing and settlement processes, as it facilitates efficient communication between banks to quickly reconcile accounts, transfer funds and settle financial obligations promptly.

Securities Trading: Swift code plays a vital role in securities trading, helping facilitate transfers between different financial institutions of securities and payments related to them, enabling efficient and accurate settlement of trades across borders.

Swift code serves as an integral intermediary in international money transfers by offering banks a uniform identification system and guaranteeing secure transmission of financial data. Furthermore, its functions help streamline processes, reduce errors, enhance efficiency and reliability across international borders transactions.

Limitations and considerations when using Swift code

Swift codes are widely utilized and recognized in international banking, when using them there are a few key points that must be remembered.

Costs and Fees: When using Swift codes to send international money transfers, fees and charges may apply. Both sender and recipient banks may charge processing fees while intermediary banks involved may also apply charges; it’s essential that these costs be factored into your overall transaction plan.

Processing Time: Swift code transfers can take longer to process than domestic transfers, as funds must pass through various intermediary banks before reaching their intended recipient. Exact processing times depend on many factors including participating banks and countries involved; to prevent potential delays when planning time-sensitive transactions it is wise to include extra buffer time.

Reliance on Intermediary Banks: Swift code transfers can require the participation of intermediary banks for successful processing. Each intermediary bank may charge fees or set its own processing timelines which can introduce complications and potentially increase costs.

Account Information: Swift codes primarily identify the banks and branches involved in a transaction, but do not contain account-specific details of intended recipients. To ensure accurate transfers, it’s critical that recipients’ complete and correct account details including account number(s) as required by their recipient bank(s).

Swift codes cover an expansive global reach; however, certain remote or less accessible areas may require alternative transfer channels in order to initiate transfers using Swift. In such instances, alternative methods or channels will need to be utilized.

Accuracy of Information: Accurate Swift code entry is critical to successful transfers; any mistyping could result in misrouted funds or failed transactions, so it’s essential that both you and the receiving bank verify it to ensure accurate routing of funds.

Compliance Requirements: Swift code transfers must comply with applicable anti-money laundering (AML) requirements and regulatory compliance measures, with banks potentially having additional procedures in place that add another layer of scrutiny that may delay processing times.

Knowing these limitations and considerations enables individuals and businesses to make more informed decisions when using Swift codes for international money transfers. Consultations with respective banks is advised, as is professional advice when necessary for an optimal transaction experience.

What is IBAN Code?

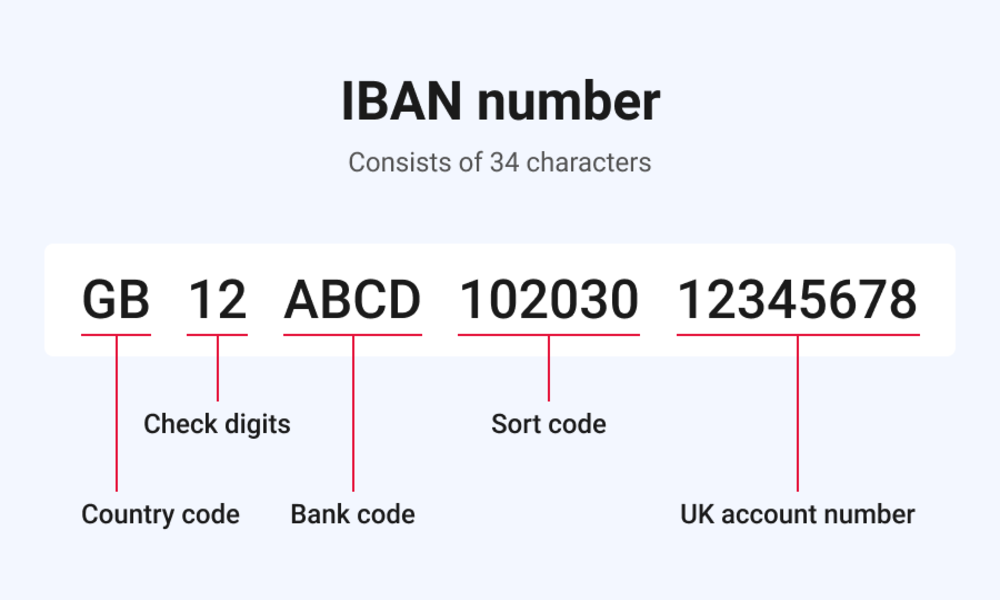

IBAN stands for International Bank Account Number. This international numbering system serves to identify bank accounts to facilitate cross-border payments. Each IBAN code gives each account its own identifier for accurate and efficient international transaction processing.

An IBAN code’s primary objective is to ensure accurate recipient bank account details and reduce errors and delays associated with cross-border payments. It has its own specific format that differs depending on which country it serves as its recipient.

These elements include:

Country Codes and Check Digits: A two-letter country code represents where bank accounts are situated while two numeric check digits serve to validate IBAN codes for accuracy.

Basic Bank Account Number (BBAN): An alphanumeric string used to identify specific bank accounts within a country.

Structure and Length of IBAN Codes in Different CountriesDepending on which country is being considered, an IBAN code’s structure and length may vary considerably between nations. For instance, within Europe (EU) and European Economic Area (EEA) this can comprise up to 34 alphanumeric characters while other nations might differ;

One of the primary advantages of IBAN codes is their ability to facilitate cross-border payments within Europe. Their introduction has significantly streamlined and simplified payment processing between European countries.

IBAN codes have become an increasingly important aspect of international transactions worldwide, enhancing accuracy and efficiency while improving accuracy. While their implementation may not be mandatory across all nations, some may still rely on other identification systems or even implement their own domestic standards for bank account numbering.

Overall, IBAN codes offer a standardized and internationally accepted method for identifying bank accounts, reducing errors, and improving cross-border payments efficiency.

Function of IBAN code in international money transfers

The IBAN code plays several vital roles in international money transfers. Below are its primary uses:

Accurate Account Identification: The primary function of an IBAN code is to accurately identify individual bank accounts involved in international money transfers. It provides a standardized format with country-specific details, check digits, and basic bank account number (BBAN), thus guaranteeing precise identification of recipient bank accounts while decreasing risk associated with incorrect routing information or account numbers.

Error Detection and Prevention: IBAN codes incorporate check digits calculated with an algorithm, to enable error detection by verifying the accuracy of IBAN code inputted. These check digits also prevent transfers initiated with incorrect account details from going ahead, decreasing the possibility of funds reaching the wrong recipient.

Facilitation of Cross-Border Payments: IBAN codes play a critical role in expediting cross-border payments within Europe and its economic area (EEA). They enable banks within these regions to seamlessly process payments while harmonizing bank account numbers across participating countries – simplifying and expediting payment processing time while benefiting both individuals and businesses conducting international transactions.

Reducing Errors and Delays: IBAN codes offer an internationally accepted format to minimize errors and delays when processing international money transfers. They ensure that recipient bank account details are accurately captured by both sending and receiving banks, streamlining the process while eliminating the need for manual intervention or corrections.

Compliance with Regulatory Requirements: Many countries have adopted IBAN systems as part of their regulatory framework for international payments, helping ensure adherence with anti-money laundering (AML) and Know Your Customer (KYC) requirements as well as transparency and traceability during international transactions. IBAN codes support transparency by supporting traceability.

Enhance Efficiency and Automation: IBAN codes enable increased automation and straight-through processing (STP) of international money transfers, with banks and financial institutions using IBANs to automate various processes like account validation, routing and reconciliation to enable faster and more efficient payment processing.

By performing these functions, IBAN codes enable accurate and streamlined international money transfers with reduced errors, delays, and compliance with regulatory standards. Their adoption has greatly enhanced cross-border payments in regions where IBAN implementation is either mandatory or widely adopted.

Adoption and implementation of IBAN codes worldwide

Adoption and implementation of IBAN codes have grown around the globe in varying degrees. Although initially introduced in Europe, their influence has since spread throughout different regions.

Here is an overview of their adoption and implementation in various regions:

Europe: Both the European Union (EU) and European Economic Area (EEA) have widely adopted the IBAN system, making IBAN codes compulsory for cross-border euro payments within EU/EEA member states as well as domestic/international transfers using this standard account identification format. IBANs have enabled seamless payments while standardizing account identification across Europe.

Middle East and North Africa: Many Middle Eastern and North African (MENA) nations have implemented the IBAN system. Countries like the United Arab Emirates, Saudi Arabia, Qatar and Egypt all utilize IBAN codes for both domestic and international transactions, as well as adopting IBAN codes within GCC countries to facilitate cross-border payments between accounts within this region.

Asia-Pacific: Adoption of IBAN codes has been more limited in Asia-Pacific compared to Europe and MENA regions; however, some countries, including Australia and New Zealand have implemented IBANs for international transactions; other nations in this region, including Singapore and Hong Kong may not mandate IBAN systems but utilize payment processing in this format for increased accuracy.

Americas: Adoption of IBAN codes has been relatively minimal in the Americas. Both the United States and Canada do not use IBAN for domestic or international transactions; instead they rely on other standardized formats like routing numbers or transit numbers as account identifiers. Some banks in these regions may request IBAN format for international transfers arriving, to ensure accurate routing and processing.

Africa: Implementation of IBAN codes can vary across African nations. Some, like South Africa and Nigeria, have adopted this system for international transactions while other African nations may utilize alternative formats or have their own domestic account numbering systems in place.

Note that, although IBAN codes provide a global standard for account identification, their adoption remains voluntary in many countries outside the EU/EEA. Still, as global banking continues to develop and the demand for greater efficiency and accuracy increases internationally payments have led to widespread acceptance and use of IBAN codes worldwide.

Countries where IBAN is mandatory or optional

Implementation of IBAN (International Bank Account Number) codes varies between countries.

Here is an overview of those where they are mandatory or optional:

Mandatory IBAN Usage in Europe and European Economic Area Countries:

Within European Union (EU) and European Economic Area (EEA) member states, use of IBAN is mandatory when making euro-denominated payments between member countries – this includes Germany, France, Italy Spain Netherlands Belgium.

Gulf Cooperation Council (GCC) Countries: Saudi Arabia, UAE, Qatar, Bahrain, Oman and Kuwait have mandated IBAN use in all domestic and international transactions.

Australia: Australia has mandated IBAN usage as part of any international payments made into and out of Australia. Their IBAN format is known as Bank State Branch Number/Account Number.

New Zealand: New Zealand has also mandated IBAN usage for all international payments incoming and outgoing. Their IBAN format is known as Bank/Branch Account Number or BBAN number and Account Number.

Optional IBAN Usage in the US:

United States: IBAN codes are optional in the U.S. While certain banks may accept IBANs for international payments, standard account identification within the country includes routing number and account number as forms of account identification.

Canada: Like in the US, use of International Bank Account Numbers is optional in Canada; banks typically rely on transit numbers and account numbers as identification methods in domestic and international transactions.

United Kingdom: Use of IBANs in the UK is voluntary; instead, its standard account identifier format consists of Sort Code and Account Number.

Other Countries: While not making IBAN use mandatory, many other nations accept them for international payments that come through, including Singapore, Hong Kong, Brazil, India, Japan and South Africa.

As countries update their banking regulations and standards, IBAN usage may change over time. Therefore, it’s wise to consult with relevant financial institutions or payment service providers in order to ascertain any specific requirements applicable to a given country or transaction.

Comparison Table of Swift Code and IBAN Code

Sure! Here’s a comparison table highlighting the key differences between Swift Code and IBAN Code:

| Swift Code | IBAN Code |

|---|---|

| Society for Worldwide Interbank Financial Telecommunication code | International Bank Account Number |

| Identifies banks and financial institutions | Identifies individual bank accounts |

| Used for secure communication and accurate | Used for accurate processing of cross-border |

| routing of international transactions | payments |

| Consists of alphanumeric characters | Consists of alphanumeric characters and digits |

| Components: | Components: |

| Bank code | Country code |

| Country code | Check digits |

| Location code | Basic bank account number (BBAN) |

Please note that this table provides a general comparison between Swift Code and IBAN Code, but the specifics may vary depending on the country and banking regulations involved.

Conclusion

Swift Code and IBAN Code are key components of international banking that ensure secure, accurate money transfers across borders.The Swift Code serves as a unique identifier for banks and financial institutions involved in international payments, providing secure communication, accurate routing, and efficient processing. However, its primary function is identifying individual banks rather than accounts within them.

On the other hand, IBAN Codes play an essential role in identifying international bank accounts involved in transactions. Their standard format provides country-specific details, check digits and basic bank account number (BBAN). Their use facilitates accurate account identification and error detection/prevention as well as increased efficiency when it comes to cross-border payments.