Definition of Quick Ratio and Current Ratio

Quick Ratio:

Quick Ratio is also referred to as Acid-Test Ratio is a financial ratio that evaluates the ability of a business to pay its short-term financial obligations with its assets that are the most liquid. This is determined by subdividing the amount of a firm’s quick asset by its present liabilities.

Quick assets are those that are able to be converted quickly into cash, like money and equivalents to cash, securities that can be traded as well as accounts receivable.

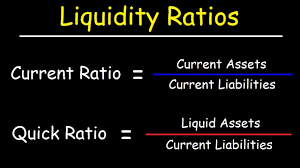

The formula to calculate Quick Ratio is:

A higher Quick Ratio means that a company is in better capacity to pay its short-term financial obligations without having to rely on the selling of assets like inventory, or any other. An lower Quick Ratio, on contrary, suggests that a company could face difficulties in fulfilling its short-term obligations.

In this case, the company may have to sell assets or inventory in order to meet its obligations.

It is crucial to remember the fact that Quick Ratio is only one of the many financial ratios utilized to assess the financial health of a company and must be considered in conjunction with other financial ratios, factors and indicators in making financial or investment decision.

Current Ratio:

It is an ratio in the financial sector that evaluates a business’s capacity to meet its financial obligations for the short-term with the current assets. Current assets are those which can be converted quickly into cash, for example money and equivalents to cash inventory, accounts receivable, inventory as well as marketable security. These are obligations to pay due within the year, like accounts payable and short-term loan.

The formula to calculate the Current Ratio follows:

A higher Current Ratio suggests that a company has better capacity to pay its short-term financial obligations because it has more assets in the present in relation to its current liabilities. The lower number might indicate that a company might struggle to meet its financial obligations for the short term.

The Current Ratio is frequently utilized by lenders, investors analysts, and creditors to determine the company’s liquidity and the financial health of the company in the short-term.

It is crucial to keep in mind that Current Ratio is one of many financial metrics that are used to evaluate the health of a company’s finances and should be viewed in conjunction with the other financial metrics and variables when making financial or investment decisions.

Comparison Chart of Quick Ratio and Current Ratio

Here’s a chart of comparison between the Quick Ratio and Current Ratio:

| Parameter | Rapid Ratio | The Current Ratio |

| Definition | The ability of a company to meet its financial obligations in the short term using its assets with the highest liquidity | The ability of a company to fulfill its financial obligations in the short term using its current assets |

| Formula | The Quick Ratio is (Quick assets / current liabilities) | The Current Ratio is (Current Assets + Current Liabilities) |

| Quick Assets | Cash equivalents, cash marketable securities, accounts payable | Cash equivalents, cash and accounts receivables inventory, marketable securities |

| Current Liabilities | Financial obligations that are due within a year, like accounts payable and loans for short-term purposes | Financial obligations that are due within a year, like accounts payable and loans for short-term purposes |

| Interpretation | A higher Quick Ratio means the ability to meet financial obligations in the short term without relying on the sale of inventory and other asset | A higher Current Ratio signifies the ability to meet financial obligations in the short term by having more assets in the present compared to liabilities in the present. |

| Benefits | Offers a more stable measurement of liquidity than the Current Ratio | Gives a comprehensive view of the company’s liquidity |

| Advantages | Does not consider inventory, which can be a major liquid source for certain businesses. | This includes inventory, which might not be readily convertible into cash for some businesses. |

| When should you apply | It is useful for businesses with huge inventory or where the inventory cannot be easily converted into cash | This is ideal for companies that have a smaller inventory or in cases where inventory is easily converted to cash |

It is crucial to remember the fact that Quick Ratio and Current Ratio are vital financial ratios to determine a firm’s liquidity and financial health in the short term.

But, they must be considered in conjunction with other financial ratios and variables in making financial or investment decisions.

Advantages and disadvantages of using the current ratio

The benefits of using the current ratios are:

Easy to calculate: The Current Ratio is simple to calculate and comprehend and is accessible to a broad range of lenders, investors as well as analysts.

Offers a broad overview of liquidity: Current Ratio is a broad measure that takes into consideration all assets and liabilities and provides a complete picture of the liquidity of a business.

Ideal for decision-making in the short term Current Ratio is especially helpful for decision-making in the short term because it gives information about a company’s capability to meet its financial obligations.

The disadvantages of using the current ratios include:

It ignores the value of assets The Current Ratio does not consider the quality of the assets or the capacity to transform these into money. A company, for Instance, might have a large Amount of inventory, however it could be outdated or Difficult to sell which could Affect its ability to fulfill its Financial Obligations in the Short term.

It ignores when cash flow The Current Ratio does not consider how often cash flow that can be crucial in determining the ability of a business to fulfill its financial obligations in the short term.

It may not be applicable to all businesses Current Ratio might not be appropriate for every company, but especially ones with a long running cycle or with substantial long-term investment.

Even though Current Ratio can be a helpful measure of financial performance, it must be taken into consideration in conjunction with different financial metrics and variables in making financial or investment decision.

Advantages and disadvantages of using quick ratio

The benefits of using a rapid ratios are:

- A more prudent measure of liquidity Quick Ratio provides a more cautious measure of a business’s liquidity than Current Ratio by excluding inventory that may not easily convert to cash for certain companies.

- The Quick Ratio can be particularly helpful for businesses with a substantial inventory or in cases where inventory isn’t easily convertible into cash, because it offers a clearer image of the ability of the business to meet its financial obligations.

- It is useful for making short-term decisions The Quick Ratio is especially helpful for decision-making in the short term because it gives an insight into the company’s capacity to pay its short-term financial obligations without having to rely on selling stocks or assets.

Some disadvantages of using a quick ratios include:

- It ignores how cash flows are arranged. flow: Quick Ratio does not examine how often cash flow that can be crucial in determining the ability of a business to pay its short-term financial obligations.

- It ignores the value in assets: Quick Ratio fails to consider the quality of assets, or the capacity to transform these into money. A company, for instance, might have a large amount of accounts payable however, they could not be collectible, which may hinder its ability to meet its financial obligations in the short term.

- It may not be applicable to every business: The Quick Ratio might not be applicable to every company, but especially those with a smaller stock or that have an inventory that can easily be converted into cash.

Although Quick Ratio is an effective ratio of financial value, it must be viewed in conjunction with various other ratios of financial value and variables when making financial or investment decision.

How do you interpret the current ratio?

The current ratio is a Measure of the Company’s ability to fulfill its Financial obligations in the short term using the Assets it has at hand. A ratio of at least 1 is usually an Excellent indication that a Business is able to fulfill their short-term Financial obligations. These are General rules to Interpret your Current ratio:

Current Ratio 1. If a firm has an current ratio of one this means it has only enough actual assets to meet the current obligations. Although this isn’t an Ideal Situation, it’s not the Cause of Worry.

Current Ratio that is less than 1. If a business currently has a ratio less than one this indicates that it might be having trouble fulfilling its short-term financial obligations by using its existing assets. That could raise a red flag to investors as it indicates that the company might have difficulties paying its obligations.

Current Ratio that is greater than 1: If a business has a ratio of greater than 1 indicates there are more assets in its current position than its current liabilities. It is usually Regarded as an Indication of a Company’s Capacity to meet its Financial Obligations.

High Current Ratio High Current Ratio: A high ratio of current could mean that a business has surplus current assets that aren’t utilized efficiently. This could mean that the business isn’t investing its capital in a way that is efficient.

It is crucial to remember that the current ratio shouldn’t be taken as the sole indicator of a firm’s financial health. Analysts and investors should look at other financial ratios as well as other factors, like the level of debt, profitability, and cash flow when making financial or investment decision.

How to interpret quick ratio

Quick ratio (also referred to as acid test rate) measures the ability of businesses to fulfill financial obligations by using liquid assets including inventory as repayment sources. Here are general guidelines for understanding whether quick ratio is in check:

Quick Ratio 1: An organization’s immediate ratio should not be exceeding one; this indicates they only have enough cash reserves on hand to cover current obligations without incurring further debts. While not ideal, such an outcome shouldn’t cause major concern.

An issue for investors could arise when their company has a quick ratio below one; such a situation indicates they might face difficulty covering its short-term obligations with its liquid assets and will have difficulty meeting expenses on time. A quick ratio that falls under 1 is an indicator that this business might face difficulty covering short-term obligations with liquid assets available to it, possibly signalling problems in managing expenses over the short-term period.

Quick Ratio Greater than One If your business boasts an effective Quick Ratio greater than 1, it indicates more immediate assets exist relative to current liabilities – an indicator of its ability to meet financial obligations and pay its obligations on time.

An increase in quick ratio indicates that there may be excess quick assets not being utilized effectively by a company and could indicate misappropriated capital usage by them.

As Quick Ratios should not be seen as the sole indicator of financial health for companies, analysts and investors must also factor in other ratios and aspects such as efficiency, debt levels and cash flows when making financial or investment decisions.

Scenarios where quick ratio is more appropriate

This ratio, more commonly referred to as an acid-test ratio is most suitable in certain scenarios:

Unfortunately, I’ve always found this to be untrue – at least, that’s my impression from being exposed to so much different information from different people! So… here we go… my top three (out of seven total!) selections for your consideration in relation to creating and growing businesses online.

Companies with inventory which is difficult to convert into cash: Quick ratios may be better suited for companies whose inventory cannot easily be converted to cash; such as firms selling perishable goods or items susceptible to technological developments; where current ratios could overestimate a company’s capacity to meet financial obligations.

Businesses with long periods of inventory turnover (e.g. manufacturing companies) might benefit more from using the rapid ratio than current ratio in representing their ability to meet financial obligations in the short-term.

Quick Ratio Is Best Suited for Short-Term Decision-Making, quick ratio provides useful insight into a company’s short-term ability to meet financial obligations without selling assets or inventory – especially useful during times of emergency when quick financial decisions may need to be taken quickly.

Focused investors tend to prioritize liquidity. The fast ratio is an additional measure of the ability of an organization to meet its financial obligations and thus may serve as an accurate gauge.

Rapid ratio is ideal for companies that struggle to convert inventory to cash quickly or when making short-term financial decisions; it must however be evaluated alongside other relevant ratios and variables when making important financial or investment decisions.

Scenarios where current ratio is more appropriate

These solutions are more ideal in these circumstances:

Businesses with substantial inventories such as wholesalers or retailers would do better using the current ratio as its calculation takes inventory into consideration, offering more accurate indication of its ability to meet its financial obligations.

Service-oriented companies may find the current ratio an invaluable way to evaluate their fiscal health. With less physical assets and liabilities at play in these organizations, using it provides more accurate measurement.

Investors Focused on Repaying Debts: Investors interested in the company’s capacity to repay its debts may prefer this ratio because it takes all current assets and liabilities into consideration in its calculation; providing an accurate evaluation of whether its financial obligations can be fulfilled.

Companies with stable cash flows would find this ratio especially helpful as it illustrates a company’s capacity to meet financial obligations – this approach especially works well when applied to businesses such as utilities.

General speaking, businesses with larger inventories, shorter operating cycles or stable cash flows tend to fare better under present ratio analysis than businesses without. But it should still be taken into consideration along with other financial ratios when making investment or finance-related decisions.

Conclusion

Current ratio and quick ratio are both commonly employed financial ratios that provide information about a company’s ability to meet short-term obligations, with current ratio being an indicator of how its current assets meet current obligations, while quick ratio measures their liquid assets (such as inventory).

Both ratios offer advantages and drawbacks, and can be useful depending on a company’s circumstances. Quick ratio is best used by organizations with more inventory with short operating cycles or predictable cash flows while quick ratio may provide additional support if businesses struggle converting inventory to cash or need to make short-term financial decisions.

Analysts and investors must carefully consider ratios alongside other financial ratios and variables when making investment or financial decisions for any given business, in order to gain an overall picture of its financial health.